Triangle Area Real Estate and Other Interesting News

Your Local Chapel Hill and Durham Experts

Neighborhood Spotlight: Corbinton in Hillsborough, NC…

Hillsborough is home to a new active adult community, Corbinton, which is located conveniently between Durham…

Where's the Best Place to Live in North Carolina?…

Photo courtesy of downtowncary.org. Money magazine recently named Cary, North Carolina as the best place to l…

Is a 20% Home Loan Down Payment Necessary?…

Image courtesy of housingwire.com. If there is one area in real estate that confuses potential home buyers, it…

Home Improvements: Trends and ROI…

Home Improvements If you are considering making home improvements, one of the primary considerations will be t…

Neighborhood Spotlight: 5401 North in North Raleigh…

5401 North Neighborhood in North Raleigh A unique and exciting new neighborhood concept is under constructi…

What Is A Smart Home? Are They Hot or Not?…

Smart homes are hot right now in residential real estate. Recent consumer polling data shows that buyers are …

The Best Time to Buy a House - Should You Buy Now or Wait?…

Figuring out the best time to buy a house is probably the biggest decision you will make. It can be an excitin…

Who Qualifies for a VA Home Loan…

Are you a Veteran or currently serving in the military? Are you ready to buy a new home? If you answered "yes"…

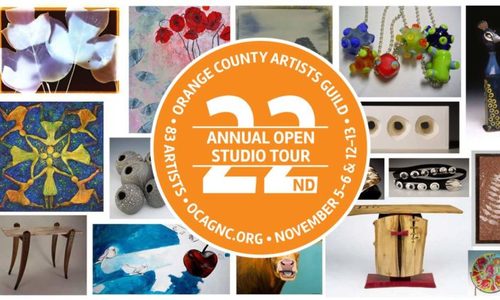

Orange County Artists Guild Annual Studio Tour…

Whether you are an art aficiondo or are just looking for something fun and unique to do in November, you won't…

Search

Recent Posts

Categories

- Array (8)

- Awards (5)

- blog (8)

- Buyer (31)

- Buying (6)

- Buying a home (57)

- Chapel Hill (14)

- Consumer Alerts (2)

- Conventional Loans (3)

- Downsizing (3)

- Energy Efficiency (14)

- Featured (103)

- Flipping Houses (2)

- Foundation Problems (1)

- Green Homes (5)

- Green Living (16)

- High Performance Homes (6)

- Home Buyer Tips (3)

- Home Decor (3)

- Home Design Trends (2)

- Home Improvement (13)

- Home Inspections (4)

- Home Loans (10)

- Home Staging (8)

- Inspection Items (1)

- Market Update (19)

- Mortgages (10)

- NAR Settlment (1)

- Net Zero Energy (5)

- Net Zero Homes (2)

- Press Release (3)

- Property Management (15)

- Real Estate Experts (26)

- Repair Issues (1)

- Sellers (23)

- Selling (2)

- Selling a home (14)

- Selling your home (38)

- Senior Living (4)

- Uncategorized (668)